Guernsey operates an efficient, simple and flexible regulatory regime.

Every “collective investment scheme” (a fund) domiciled in Guernsey will be subject to the provisions of Guernsey’s principal funds legislation – The Protection of Investors (Bailiwick of Guernsey) Law, 2020 (POI Law) – and regulated by Guernsey’s regulatory body for the finance sector – the Guernsey Financial Services Commission (GFSC).

Broadly speaking:

- Every fund domiciled in Guernsey (a Guernsey fund) must be administered by a Guernsey company which holds an appropriate licence under the POI Law to do so. The administrator is responsible for ensuring the fund is managed and administered correctly.

- Every open-ended Guernsey fund must also appoint a Guernsey company which holds an appropriate licence under the POI Law to act as custodian (or trustee where the Guernsey fund is a trust). The trustee/ custodian is (with limited exceptions) responsible for safeguarding the assets of the fund and, in some of the rules, to oversee the management and administration of the fund by the administrator.

Guernsey funds regulation only applies to “collective investment schemes”: arrangements relating to property of any description which have each of the following characteristics:

- the pooling of contributions by investors;

- third party management of the assets; and

- a spread of risk.

Thus arrangements with a single investor or a single asset would not usually be classified as a fund.

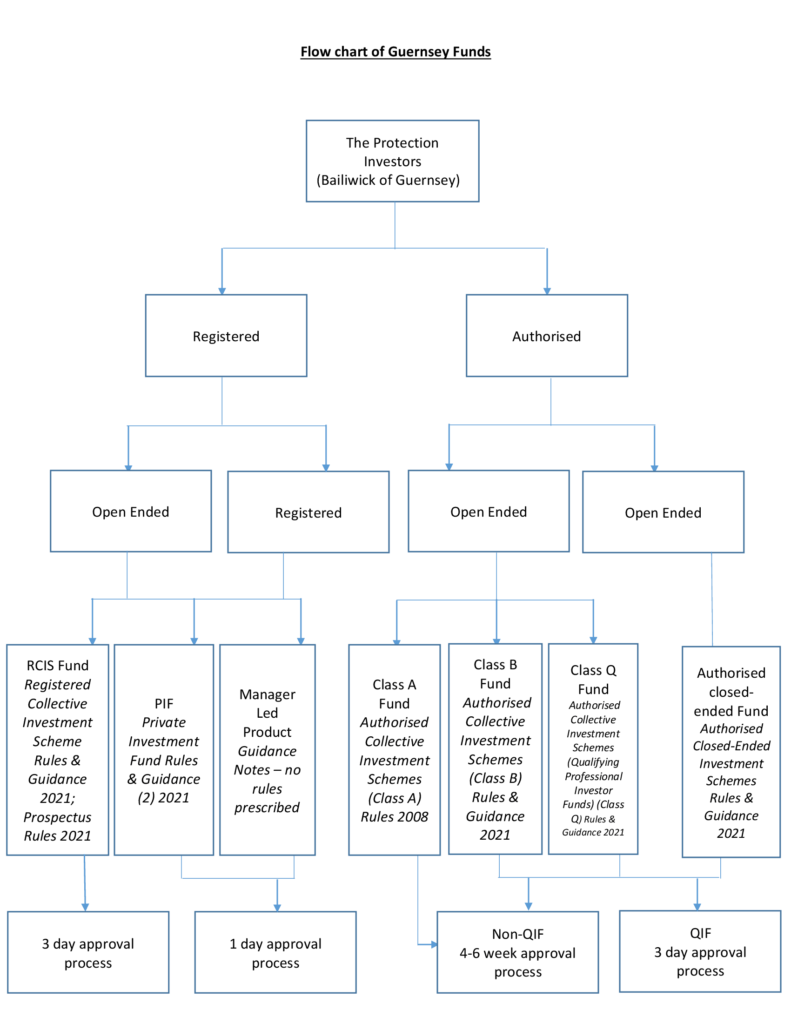

Authorised or Registered

The POI Law splits Guernsey funds into two categories:

- “registered funds”, which are registered with the GFSC; and

- “authorised funds”, which are authorised by the GFSC.

The difference between authorised funds and registered funds is essentially that authorised funds receive their authorisation following a substantive review of their suitability by the GFSC, whereas registered funds receive their registration following a representation of suitability from a Guernsey body holding a POI Law licence (the administrator, who scrutinises the fund and its promoter in lieu of the GFSC and takes on the ongoing responsibility for monitoring the fund).

The POI Law grants the GFSC the ability to develop different classes of authorised and registered funds and determine the rules applicable to such classes.

Funds seeking authorisation or registration must therefore satisfy the requirements of the POI Law and (where applicable) the applicable rules specified by the GFSC.

Open or Closed ended

The rules governing the different classes of Guernsey funds state whether they are open-ended or closed-ended (or can choose from either).

A Guernsey fund is open-ended if the investors are entitled to have their units redeemed or repurchased by the fund at a price related to the value of the property to which they relate (i.e. the NAV).

There is no prescribed frequency of redemption or period within which the redemption moneys be paid.

The following table summarises Guernsey fund structures: