Essentially the “Fund Industry” is everything associated with the operation of an investment fund and the parties involved right from the inception of the idea of the investment fund through to its launch and then its day to day management, administration and oversight. The fund industry involves a multitude of different skill sets and levels of expertise and experience.

What is an Investment Fund?

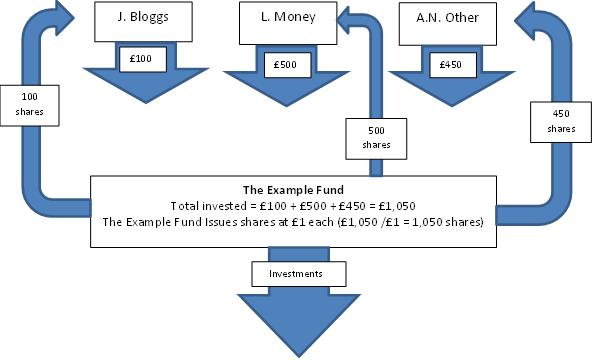

A supply of capital (cash for investment) belonging to numerous investors that is used to collectively purchase securities while each investor retains ownership and control of his or her own shares in the Fund.

Typically, an investment fund provides a broader selection of investment opportunities resulting in a spread of risk, greater management expertise and lower investment fees than investors might be able to obtain by investing directly on their own.

An investment fund will issue a prospectus in which it will lay out its strategies, how the investment fund is structured, the related risks, details of the key parties involved and other salient details.

Individual investors do not make decisions about how an investment fund’s assets should be invested. They simply choose which investment fund to invest in based on its goals, risk, fees and other factors. A Fund Manager (or Investment Manager/Investment Adviser) actually oversees the fund and decides which securities it should hold, in what quantities and when they should be bought and sold.

Examples of investment funds include

- Private equity funds (think of the TV program Dragons Den – they are the type of investments a private equity fund may make)

- Hedge funds

- Exchange traded funds

- Index tracker funds

- Money market funds

- Equity funds

- Emerging market funds

- Debt funds

Typically investment funds will be structured as unit trusts (governed by a Trust Deed and issuing units to investors) or as companies (governed by a Memorandum & Articles of Association and issuing shares to investors).

Whether they are unit trusts or companies the basic principals remain the same and they are regulated under the same regulations.

Open-ended or closed-ended?

Investment funds can be “open ended” or “closed ended”. Open ended investment funds allow investors to by and sell or buy their shares on a regular basis. Closed ended investment funds require investors to leave their funds invested for a fixed amount of time. The reason for having closed ended investment funds is because the underlying investments tend not to be readily saleable (such as property or infrastructure) so the Fund Manager can not easily sell the assets on a regular basis to allow investors to sell their shares in the investment fund.

Regulation

Finally, investment funds, particularly those targeted at retail (non-professional or non-experienced) investors, will be regulated (the regulator in Guernsey is the Guernsey Financial Services Commission (“GFSC”)) and will also require a trustee (for a unit trust) or custodian (for a company) to independently hold and protect the assets of the investment fund for its investors.

Investment funds are also known as “collective investment schemes” or “funds”.

Example of an Investment Fund Structure

Jobs in the Fund Industry

Essentially the “Fund Industry” is everything associated with the operation of an investment fund and the parties involved right from the inception of the idea of the investment fund through to its launch and then its day to day management, administration and oversight. The fund industry involves a multitude of different skill sets and levels of expertise and experience.

Some jobs include:

Lawyers – in respect of Funds, lawyers are often involved in the initial work prior to the launch of the Fund; setting up the fund structure, drafting the documentation in respect of the Fund (such as the prospectus) and drafting up agreements for the Fund to appoint their service providers. Throughout the life of the Fund lawyers may be involved for re-structuring purposes or to provide advice and guidance.

Fund Manager/Investment Advisor – manages the fund investments and makes investment decisions or recommendations to buy and/or sell the Fund’s investments.

Custodian/Trustee/banker – a custodian holds the assets of the underlying fund on behalf of the Fund. A closed ended fund does not always need a custodian as, depending on the type, their assets can be held directly in the name of the Fund and not through the Custodian. All Funds need a banker to hold cash on their behalf. An open ended Fund requires a Custodian Trustee who is, amongst other things, responsible for overseeing the Fund Administrator.

Fund Administrator – all Guernsey Funds need to appoint a Guernsey based administrator. The administrator keeps a record of the fund’s assets and expenses (books and records) and provides regular valuations and financial statements for the Fund.

Company Secretary – often a service provided by the administrator which involves the running of the Fund’s statutory and corporate requirements (often a Fund is set up as a corporate structure (company) with a board of directors who have meetings and produce minutes etc). The Company Secretary manages the meetings, produces the minutes and liaises with the directors.

Transfer agent/registrar – Keeps a record of the Fund’s investors, collects investment money and pays out redemption money for investors. Also deals with investor queries and pays out dividends to investors (a dividend is income paid to investors whilst they remain invested in the fund (a bit like bank interest)). Quite often the Administrator will also act as the transfer agent/registrar.

Auditors – the auditor reviews and signs off the financial statements for the Fund which the administrator has produced. Auditing includes reviewing the systems, controls and processes the administrator uses in addition to reviewing the data they produce.

Tax specialist – a tax specialist may provide advice to a Fund on the most efficient way to structure the fund. Tax reporting services are also offered by a tax specialist.

Many of the service providers detailed above are regulated by the Guernsey Financial Services Commission (GFSC). The service providers have to adhere to the relevant rules and regulations which are monitored by the GFSC. To do this the service providers will have a Compliance function which oversees their own processes and controls to ensure they meet the regulatory requirements.

Anti money laundering – Guernsey, as a fund jurisdiction, is highly regulated (by the GFSC). As a result, service providers have to have controls in place to prevent criminals using the Island and the products we offer as methods to launder money or finance terrorism. The service providers are responsible for collecting information and client due diligence on their clients or on investor into the funds. This can form part on the day to day administration or a separate team may be responsible for this function.

Human Resources (HR) – All of the Fund service providers employ people and, in order to do this, they need people who are responsible for recruitment, payroll and general employee related tasks. These people usually form part of the HR department.

Systems – In order to provide financial services all service providers will use Information Technology and will therefore need people to support their technology to prevent and breaks in service this can be either an in house team of IT people or can be outsourced to companies which specifically provide this service.

The table below sets out the typical jobs in the set-up and operation of an investment fund and which periods they may be involved over the fund’s life cycle.

| Participants | Life of an Investment Fund | |||

| INTERNAL | Launch | Day to Day | Oversight | Termination |

| Executive Directors | x | x | x | x |

| Trustee/Custodian | x | x | x | x |

| Manager (local) | x | x | x | x |

| Administrator | x | x | x | |

| Transfer Agency | x | x | x | |

| Compliance | x | x | x | x |

| Company Secretary | x | x | x | x |

| IT | x | x | x | |

| Lawyer (internal) | x | x | x | |

| Project Management | x | x | ||

| EXTERNAL | Promoter | x | x | x |

| Manager (overseas) | x | x | x | |

| Investor | x | x | x | |

| Lawyer | x | x | ||

| Tax Adviser | x | |||

| Regulator | x | x | x | |

| Non-Executive Directors | x | x | x | |

| Company Registrar | x | x | ||

| Investment Adviser | x | |||

| Broker | x | |||

| Auditor | x | x | x | |

| Banker | x | x | x | |

| Liquidator | x | |||

| Court | x |

Other than for the role of Executive Director, Internal roles typically have up to 4 stages of position or development:

- Trainee – learning

- Trained – 2 to 3 years on the job

- Senior – 3 to 5 years in the job and taking qualifications

- Manager – 5+ years and has some qualifications or more years and very experienced

Some of the roles may be supplied by a company specialising just in that discipline e.g. Compliance, Transfer Agency.